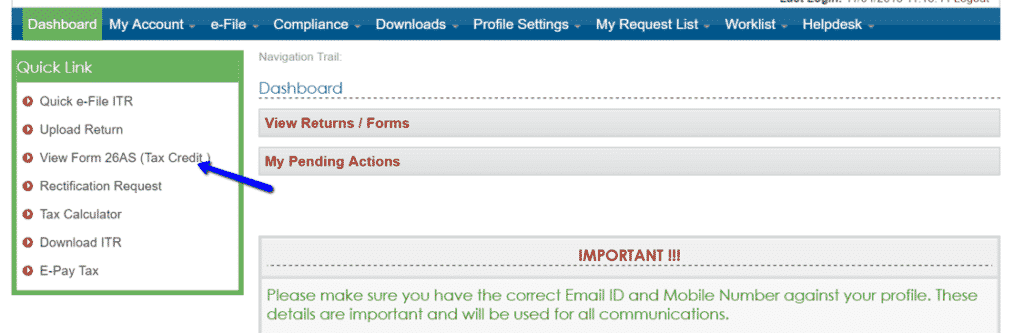

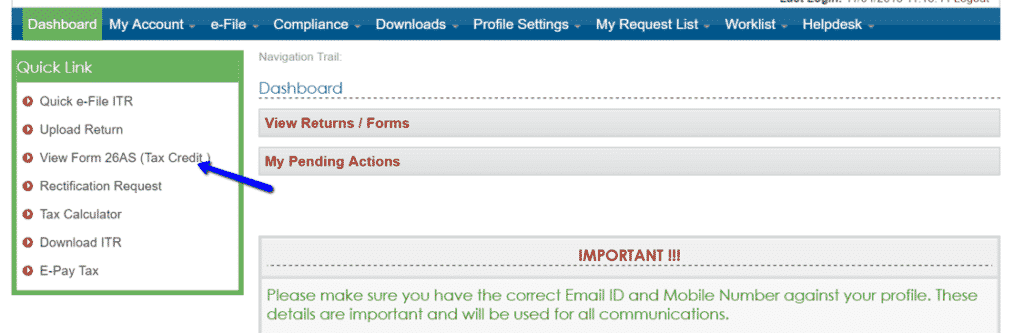

You can also check if the tax collected on their behalf has been deposited with the income tax department. Through Form 26AS, you can cross-check the TDS statement to verify if the deductor has provided accurate details about the TCS. Given below are 3 crucial reasons that make Form 26AS so important: Other details like dividends, interest received on income tax refunds, salary breakup, off-market transactions, and foreign remittances.ģ Major Reasons Why Form 26AS is Important. Details of high-value transactions related to shares, mutual funds, return on investments, etc. Details of all income tax refunds received in the financial year. Regular assessment tax paid by taxpayers. Details of advance tax payments made to the income tax authorities. Details of taxes collected by collectors. Information on the TDS deducted by your employer on your salary. Given below are the various details mentioned in Form 26AS that make this crucial for return filing: What is Form 26AS?įorm 26AS is an annual income tax statement that contains information regarding all the TDS transactions during the financial year. In this blog, we will look at the scope of the new form to learn what all is included in it and how we can download and submit Form 26AS online. The extent of this form has also been expanded to include other details like refund details, foreign remittances, mutual fund purchases, dividends, etc.

You can also check if the tax collected on their behalf has been deposited with the income tax department. Through Form 26AS, you can cross-check the TDS statement to verify if the deductor has provided accurate details about the TCS. Given below are 3 crucial reasons that make Form 26AS so important: Other details like dividends, interest received on income tax refunds, salary breakup, off-market transactions, and foreign remittances.ģ Major Reasons Why Form 26AS is Important. Details of high-value transactions related to shares, mutual funds, return on investments, etc. Details of all income tax refunds received in the financial year. Regular assessment tax paid by taxpayers. Details of advance tax payments made to the income tax authorities. Details of taxes collected by collectors. Information on the TDS deducted by your employer on your salary. Given below are the various details mentioned in Form 26AS that make this crucial for return filing: What is Form 26AS?įorm 26AS is an annual income tax statement that contains information regarding all the TDS transactions during the financial year. In this blog, we will look at the scope of the new form to learn what all is included in it and how we can download and submit Form 26AS online. The extent of this form has also been expanded to include other details like refund details, foreign remittances, mutual fund purchases, dividends, etc.

The income tax authorities have also made numerous changes in the Form 26AS itself to include more details. The days of manually downloading Form 26AS are long gone, owing to the new and improved income tax portal. Form 26AS is a tax credit statement and one of the most important documents related to income tax return filings.

0 kommentar(er)

0 kommentar(er)